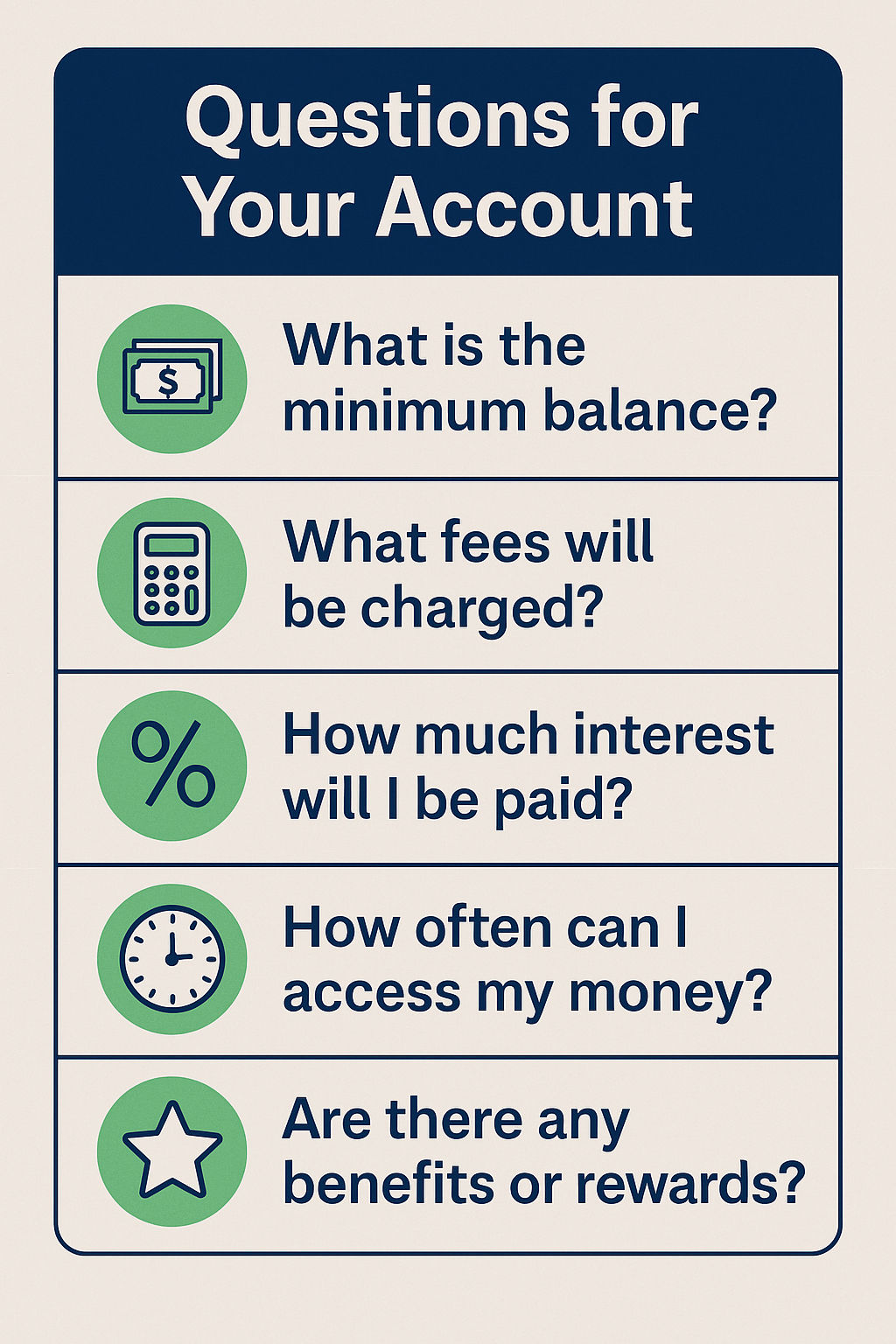

Are you ready to embark on the journey of opening your first bank or credit union account? Before diving in, it’s crucial to ask the right questions to ensure you make the best financial decision. Here are the top five questions you need to consider, expertly crafted with SEO in mind to guide you towards a savvy banking choice.

1. What is the Minimum Balance Requirement?

Understanding the minimum balance requirement is your first step in opening a bank account. This figure dictates the initial deposit needed to activate the account and, potentially, the ongoing balance you need to maintain monthly. Clarifying this can help prevent unexpected fees, particularly if your account balance fluctuates. By understanding these terms, you’re setting a solid foundation for maintaining a healthy account balance.

2. What Fees Will I Be Charged?

Navigating the world of bank fees is essential for maintaining financial wellness. Ask about any potential charges, such as monthly maintenance fees, non-sufficient funds fees, and transaction fees associated with checking accounts. While savings accounts typically have fewer fees since banks leverage these deposits for other financial products, like loans, it’s essential to know all associated costs. Awareness of these fees allows you to choose the right account for your financial habits and avoid unnecessary expenses.

3. How Much Interest Will I Earn?

Interest earnings play a crucial role in account selection. Ask about the interest rates for both checking and savings accounts to understand your potential earnings. Savings accounts usually offer higher interest because banks invest these funds in loans and mortgages. In contrast, checking accounts may have minimal interest. Knowing the exact interest rates and how they benefit you can help you make an informed decision that grows your wealth over time.

4. How Accessible Are My Funds?

Consider the liquidity of your accounts when selecting them. Checking accounts offer high liquidity, allowing frequent transactions for daily expenses. However, savings accounts might have restrictions on the number of monthly withdrawals. It’s important to ask about these limitations and any penalties for excessive transactions. By understanding liquidity, you can manage your finances effectively and access your funds whenever necessary.

5. Are There Any Benefits or Rewards?

Bank accounts often come with unique benefits and rewards. Inquire about perks like financial tools, discounts, or higher interest rates offered by both checking and savings accounts. Uncovering these extras can significantly enhance your banking experience and provide additional value. Make sure to compare these benefits across various account types to maximize your potential gains and align them with your financial goals.

By addressing these five essential questions with your bank or credit union representative, you’re not only making an informed decision but also laying the groundwork for a prosperous financial future. Utilize this SEO-optimized guide to refine your approach and choose the bank account that best aligns with your needs and lifestyle, thereby securing your financial success.